Cyara launched its Global Innovation Centre in Hyderabad, India, in January this year, marking a significant investment in the country. The 200-seat facility is set to boost its product and AI capabilities, with the company planning to hire approximately 150 professionals by the end of this year. According to CEO Rishi Rana, “India is home to some of the brightest minds in technology,” and this new centre will serve as a global hub for innovation in CX Assurance tools and AI research.

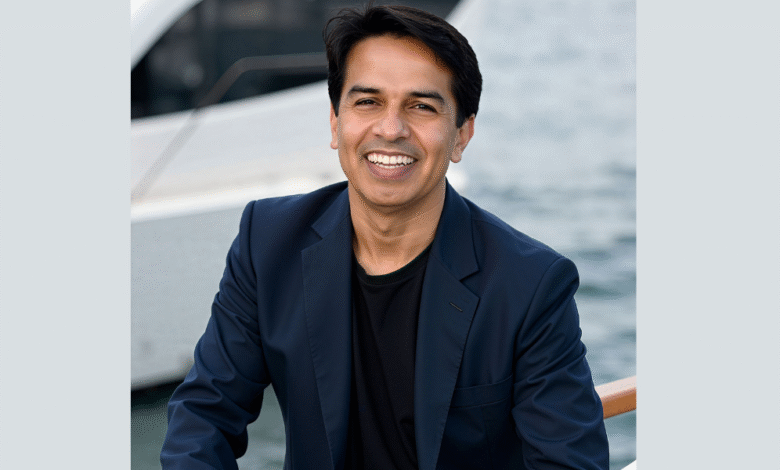

To delve deeper into Cyara’s India strategy and understand what this Innovation Centre means for the company’s global ambitions, GCC Pulse invited Rishi Rana, President and Chief Executive Officer of Cyara, for an exclusive Q&A. In this candid conversation, Rishi shares his vision for the Hyderabad GIC, the talent philosophy guiding Cyara’s India journey, and how the company is shaping the future of CX assurance in an AI-first world.

Q. What made Hyderabad the ideal choice for Cyara’s Global Innovation Centre? How does this center align with your broader vision for growth and innovation?

Rishi: At Cyara, we are at an inflection point: scaling fast, driving category-defining innovation in CX Assurance, and serving many of the world’s top brands. Hyderabad stood out as the ideal location for our Global Innovation Centre because it offers world-class talent, a thriving tech ecosystem, and a culture of innovation.

We see this centre as a core engine powering our product development, AI research, and global delivery. It plays a critical role in helping us accelerate our roadmap, deepen regional partnerships, and bring new levels of scale and agility to our platform.

Q. How do you envision the India GIC contributing beyond just engineering support — will it also play a role in product innovation, AI/ML, or CX transformation?

Rishi: Absolutely. Our vision for the GIC goes far beyond traditional engineering execution. Our India team will drive innovation across the board, from architecting next-generation customer experience (CX) testing methodologies and Agentic AI systems to building intelligent automation into every layer of the product.

We’re embedding product, UX, and data science roles here to foster cross-functional co-creation. Our goal is to design and deliver innovations that reflect our deep understanding of customer challenges.

Q. What kind of talent is Cyara looking to attract in India? How are you planning to build a culture that mirrors the agility and customer-first mindset of your global teams?

Rishi: At Cyara, we’re building a team of thinkers, builders, and problem-solvers who are hungry to make an impact. We’re looking for people who share our values: those who embrace curiosity, act with integrity first, and believe that collaboration and customer focus are the foundation of great work.

We’re creating a culture where innovation thrives, diverse perspectives are celebrated, and our people feel empowered to grow. This includes close alignment with global teams, deep exposure to customer use cases, and a shared commitment to putting the customer at the center of everything we do.

Q. As CX rapidly evolves with GenAI and omnichannel platforms, what kind of innovation is Cyara betting on — and how will the GCC help accelerate that?

Rishi: As Conversational, Generative, and Agentic AI redefine how customers engage with brands, businesses must adopt modern testing and assurance tools to stay ahead. By embracing unified, AI-driven testing and monitoring solutions, companies can proactively ensure seamless customer experiences, build stronger brand loyalty, and unlock new opportunities for growth and innovation.

Cyara is focusing on innovation that addresses critical business challenges with solutions that accelerate the deployment of AI-driven channels and ensure they remain accurate, compliant, and reliable as technology evolves. With end-to-end visibility, AI-driven no-code automation, and real-time analytics, our unified platform delivers the most comprehensive CX Assurance across channels and countries.

Our roadmap includes predictive insights and an AI-powered copilot designed to guide enterprises in delivering friction-free CX. Much of this ongoing innovation is driven by our Global Innovation Centre in India.

Q. Many GCCs start small and scale rapidly. What’s your roadmap for headcount, capabilities, and leadership development in the India center over the next 12–24 months?

Rishi: Over the next 12–24 months, our goal is to scale to 100+ employees, with a mix of R&D, product, support, and go-to-market roles. But more than headcount, we’re focused on building cross-functional teams that can own outcomes end-to-end.

We’re also investing in local leadership and development programs that reflect our belief in growing from within. The Centre is a long-term strategic priority, and our approach is to scale intelligently and sustainably.

Q. As a leader who’s worked across global organizations, what excites you most about building in India, and what would you tell other CEOs evaluating the India GCC route?

Rishi: India is a global innovation powerhouse. What excites me most is the ability to tap into a talent pool that is tech-savvy, mission-driven, and deeply entrepreneurial. The energy here is unmatched, and the hunger to solve meaningful problems is exactly what we need at this stage of our growth.

To other CEOs: Think of India as a strategic accelerator. If you invest in the right leadership, create a culture of ownership, and make your India team part of your core mission, the impact is transformational.