There is a quiet shift underway in global boardrooms. When conversations turn to growth, resilience, and innovation, India’s Global Capability Centers are no longer viewed as support arms of headquarters. They are increasingly seen as co-owners of the enterprise agenda.

NASSCOM’s recent report, Forging Ahead: Strategic Partnerships Between Global Capability Centers and Service Providers, highlights this inflection point. Beyond the data lies a deeper reality. The GCC operating model itself is being rewritten. We have entered Wave 4.0, a phase defined by mandate rather than cost or capability alone.

From Execution Engines to the Business Core

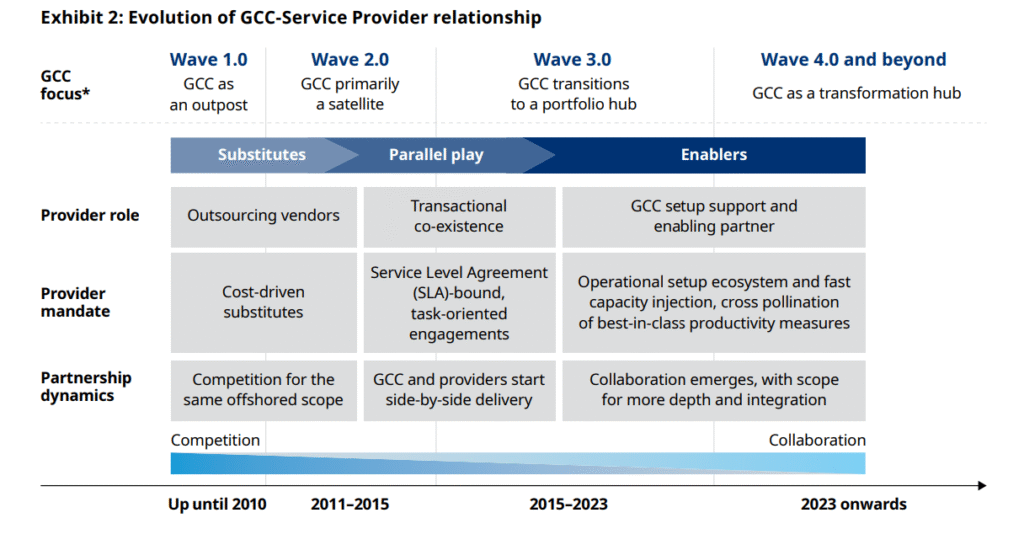

The evolution of GCCs has followed a familiar arc. Wave 1.0 focused on labor arbitrage. Wave 2.0 delivered process excellence. Wave 3.0 established India as a hub for advanced engineering, analytics, and digital transformation.

Wave 4.0 represents a structural leap. GCCs are now embedded in the enterprise core, shaping products, influencing customers, enabling revenue, and driving business outcomes. The question for the global headquarters is no longer whether work can be done in India, but how much ownership India should take.

New Age Roles Move Closer to Revenue

A defining signal of Wave 4.0 maturity is the rise of front-office and revenue-adjacent roles within GCCs. Sales enablement, marketing operations, customer analytics, and pre-sales engineering teams are scaling rapidly across India.

Sales enablement GCCs now design global playbooks, build pipeline intelligence platforms, support deal strategy, and directly influence win rates. Revenue intelligence is increasingly becoming a global capability rather than a headquarters monopoly.

Product Ownership and P&L Accountability

A major shift in Wave 4.0 is the transfer of product leadership and P&L responsibility to GCCs. Across SaaS, BFSI, and platform-driven enterprises, India-based teams are owning product roadmaps, managing lifecycles, and taking accountability for outcomes.

Strategic Partnerships From Transactional to Transformational

As GCC mandates have expanded, service provider partnerships have evolved in parallel. What began as transactional outsourcing has shifted toward outcome-driven collaboration.

In Wave 4.0, service providers act as capability accelerators. They bring niche skills, transformation frameworks, and domain depth, allowing GCCs to build complex capabilities quickly without compromising governance or control.

The Next Mandate from Global Headquarters

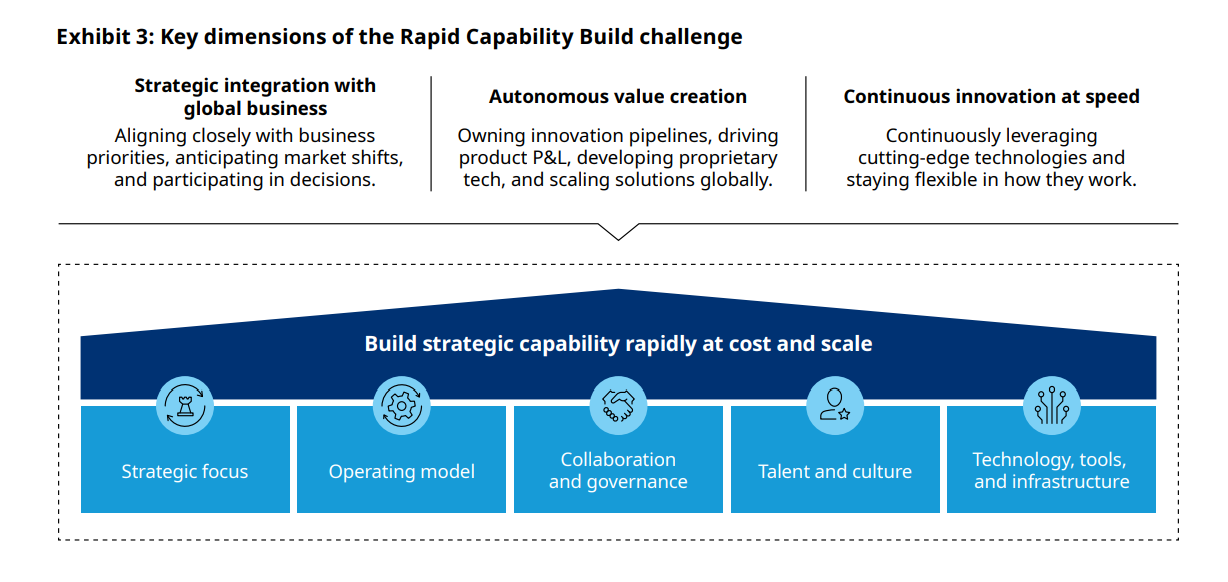

The report from Nasscom identifies three interconnected mandates shaping the next phase of GCC evolution. These include strategic integration with the global business, autonomous value creation, and continuous innovation at speed.

These expectations are emerging amid volatile markets, tighter capital discipline, and faster technology cycles. GCCs are required to scale, innovate, and deliver business impact simultaneously.

The Rise of the Next Gen GCC

These pressures are giving rise to the Next Gen GCC. This operating model is built on deep alignment between global headquarters, GCCs, and strategic partners. Next Gen GCCs are defined by outcome-based metrics, joint governance models, and ecosystem orchestration. They balance ownership with collaboration to compress time to value.

Greenfield and Brownfield GCCs: Two Paths, One Destination

Greenfield GCCs must define bold mandates early and design flexibility into their operating models from day one.

Brownfield GCCs face a harder reset. They must modernize legacy structures, rationalize partner ecosystems, and realign talent to future enterprise priorities.

The GCC Pulse View

Wave 4.0 is not about building bigger GCCs. It is about building braver ones. The differentiator going forward will be mandate clarity, leadership confidence, and partnership depth. India is no longer only where global work gets done. It is increasingly where global decisions are shaped. Wave 4.0 is underway, and the question now is who is ready to step fully into the enterprise core.