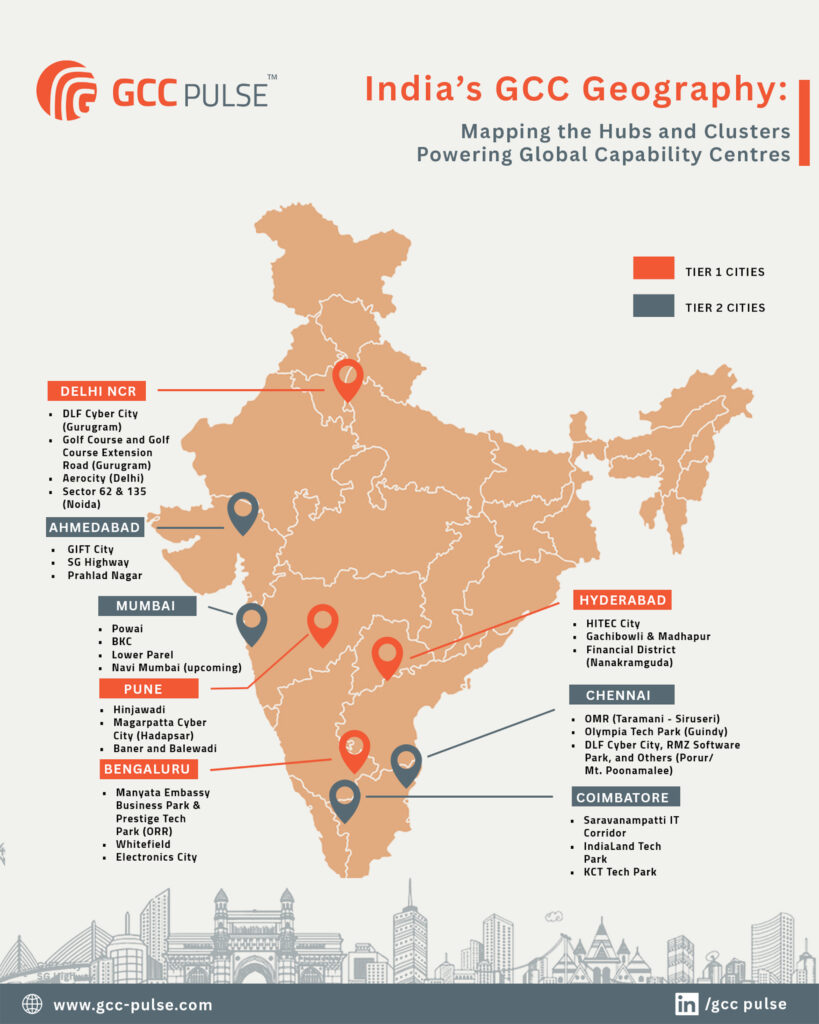

India’s Global Capability Centre (GCC) ecosystem is no longer defined by cities alone. It is shaped by corridors, financial districts, and tightly concentrated commercial micro-markets where multinational corporations run engineering, product, analytics, risk, and enterprise platforms for global operations. Across Tier 1 and Tier 2 cities, these clusters reveal how India has moved from back-office delivery to strategic capability ownership.

What distinguishes this phase of growth is the deliberate clustering of mandates within specific urban districts rather than dispersed office footprints. Understanding these localities offers a clearer view of where global enterprises are choosing to anchor long-term capability and leadership functions.

Tier 1 Cities

Tier 1 cities represent India’s most mature GCC ecosystems, with established infrastructure, deep talent pools, and a long history of multinational capability mandates. These markets host large-scale global centres spanning engineering, finance, analytics, and enterprise transformation.

1) Bengaluru

Bengaluru’s GCC story unfolds across multiple high-density corridors.

- Outer Ring Road (ORR) has evolved into one of the most concentrated global engineering belts in Asia. Companies such as Intel and Cisco operate large-scale R&D and product ownership teams here, managing global platforms rather than regional support functions.

- Whitefield, anchored by ITPL, remains home to some of India’s earliest and most mature GCCs. SAP runs core product development from this corridor, while Shell manages global technology and shared services mandates from its Bengaluru operations.

- In North Bengaluru’s Manyata Tech Park belt, global retailers and financial institutions such as Walmart and Target operate technology and analytics centres that support worldwide operations.

- Electronic City continues to host large engineering campuses, reflecting Bengaluru’s ability to support long-term R&D scale. The city’s defining strength lies in mandate complexity rather than headcount alone.

2) Hyderabad

Hyderabad’s western corridor forms a tightly integrated GCC ecosystem.

- HITEC City anchors the city’s global capability narrative. Sanofi operates innovation and digital capability teams here, while McDonald’s runs global technology operations supporting enterprise systems.

- Gachibowli has developed into a life sciences and analytics-heavy district. Eli Lilly manages technology and global services mandates from this belt, reinforcing Hyderabad’s pharmaceutical advantage.

- The Financial District and Nanakramguda represent the next layer of expansion, attracting multinational campuses seeking large-format infrastructure for finance, operations, and digital transformation mandates.

- Hyderabad’s growth is characterized by planned commercial development and increasing ownership of global platforms.

3) Pune

Pune’s GCC geography reflects its industrial backbone.

- Hinjawadi, anchored by Rajiv Gandhi Infotech Park, houses engineering-driven centres supporting global product development. Multinationals across automotive and industrial sectors use this corridor for ER&D and embedded systems work.

- Magarpatta Cybercity has attracted dedicated global centres such as ICE Mortgage Technology, reinforcing Pune’s role in enterprise software capability.

- In Baner and Balewadi, companies like Cummins India operate global IT and competency centres that support worldwide industrial operations.

Pune competes not on brand visibility but on depth of engineering ownership.

4) Delhi NCR

Delhi NCR operates as a multi-nodal GCC ecosystem spanning Gurugram and Noida.

- Gurugram’s DLF Cyber City and Golf Course Road corridors host banking and financial services GCCs with global mandates. Institutions such as American Express run technology and analytics platforms from the region.

- Noida’s SEZ-backed sectors, particularly 62 and 135, provide scalable infrastructure for global finance, risk, and operations teams.

- NCR’s strength lies in its alignment with banking, compliance, and enterprise service functions that require proximity to regulatory and policy networks.

Tier 2 Cities

Tier 2 cities are emerging as strategic expansion corridors within India’s GCC landscape. While smaller in scale, they offer cost efficiency, focused sector strengths, and growing commercial infrastructure that support calibrated multinational growth.

1) Coimbatore

Coimbatore’s GCC presence reflects its engineering heritage and steady industrial base.

- Saravanampatti IT Corridor forms the core of the city’s capability activity, anchored by developments such as IndiaLand Tech Park and KCT Tech Park. This belt has attracted engineering-led global capability centres, with companies like Bosch and SLB building long-term mandates that integrate manufacturing expertise with digital engineering platforms.

- Kalapatti Road, Avinashi Road, and Peelamedu extend the commercial footprint beyond the primary corridor, supported by strong academic institutions and stable workforce retention.

Coimbatore’s GCC strength lies in focused product engineering and industrial technology mandates, prioritising depth and operational stability over large-scale expansion.

2) Chennai

Chennai’s GCC footprint reflects its strength across BFSI, healthcare, and industrial engineering mandates.

- OMR (Tharamani to Siruseri belt) has emerged as the city’s primary campus corridor for global capability centres. Developments such as Ramanujan IT Park, Ascendas IT Park, and TIDEL Park host multinational mandates, with companies like AstraZeneca and Standard Chartered operating significant global functions from this stretch.

- Guindy serves as a centrally connected business district led by Olympia Tech Park, supporting established financial services and enterprise technology mandates within a mature commercial ecosystem.

- Porur / Mount Poonamallee extends the footprint westward, anchored by DLF Cybercity and RMZ developments that house diversified engineering, banking, and corporate capability centres.

Chennai’s GCC strength is concentrated in diversified sector mandates spanning financial services, life sciences, and industrial engineering platforms.

3) Mumbai

Mumbai’s GCC footprint mirrors its financial identity.

- Powai has emerged as a significant campus destination for global banking technology. Morgan Stanley and JPMorgan Chase operate technology, data, and risk capability centres supporting worldwide markets.

- Bandra Kurla Complex (BKC) serves as the premium financial district for global banking mandates. Barclays and Standard Chartered maintain substantial technology and compliance operations within this corridor.

- Lower Parel and adjoining commercial belts extend the ecosystem into additional finance and operations-focused office districts.

A more structural shift is now underway in Navi Mumbai. Following the approval of Maharashtra’s dedicated GCC policy in 2025, the state signed a landmark agreement to develop India’s first planned GCC City across a 100-acre site in the region. The initiative includes large-scale investment commitments spanning data infrastructure, global competency facilities, and logistics, with projections of thousands of direct jobs.

Mumbai’s GCC strength is concentrated in global banking infrastructure and risk platforms.

4) Ahmedabad

Ahmedabad’s GCC narrative is anchored by GIFT City, India’s designated international financial services centre. The zone has attracted global capability mandates across financial technology, digital engineering, and energy operations, with companies such as Cognizant establishing a TechFin-focused centre and Technip Energies expanding its operating presence within the district.

Operating within a regulated SEZ framework, GIFT City provides structural advantages for finance-led global functions. Surrounding corridors such as SG Highway and Prahlad Nagar are beginning to support corporate spillover, gradually extending the city’s capability footprint beyond the core financial enclave. MNCs such as Kraft Heinz operate from the capital of Gujarat.

Our PoV: The Evolving Hierarchy of India’s GCC Landscape

India’s GCC geography reflects a clear hierarchy. Tier 1 cities offer a depth of mandate and ecosystem maturity built over years of multinational presence, while Tier 2 cities provide focused, cost-efficient expansion corridors with emerging specializations and operational stability.

As mandates grow more strategic and innovation-led, these clusters are becoming decision-making and platform-building centres within multinational networks, positioning India as a core node in global enterprise architecture rather than a peripheral delivery base.