Global Capability Centers (GCCs) have evolved far beyond their initial role as cost-efficient back offices. Today, they are strategic hubs that drive innovation, digital transformation, and operational excellence for multinational corporations and Fortune 500 companies.

However, the remarkable success of GCCs is not achieved in isolation. Behind the scenes, a dynamic “enabler ecosystem” is at work, consisting of consulting firms, talent acquisition agencies, market research companies, boutique advisory services, real estate developers, and academic institutions. Together, these enablers provide the specialized expertise and infrastructure that empower GCCs on many fronts.

Consulting Firms: Architects of Strategic Transformation

Consulting firms have long been the backbone of GCC strategy. They offer crucial guidance on market entry, operational models, and digital transformation strategies. These firms work closely with parent companies to design frameworks that ensure GCCs are aligned with broader business objectives.

By providing insights into industry best practices and emerging trends, consulting firms help GCCs transition from mere service centers to innovation engines. Major consulting practices have been instrumental in reimagining GCC operations, advising on process optimization, technology adoption, and change management, thereby enabling GCCs to drive value creation through innovation and improved performance.

Talent Acquisition Firms: Building the Human Capital Foundation

The success of any GCC is inherently tied to the quality of its talent. In an era where technological prowess and agile thinking are paramount, talent acquisition firms play a critical role. These agencies specialize in sourcing top-tier professionals—from data scientists and software engineers to cybersecurity experts and AI specialists.

They leverage advanced recruitment tools and data analytics to match the right skill sets with the evolving needs of GCCs. By developing robust employer branding strategies and offering tailored recruitment solutions, talent acquisition firms help GCCs attract and retain the very best, building a diverse, agile, and innovative workforce prepared for global challenges.

Research and Boutique Firms: Catalysts for Innovation

Continuous innovation is key to maintaining a competitive edge. Research institutions and boutique advisory firms contribute significantly by providing in-depth market analysis, specialized research, and niche expertise. These firms offer bespoke solutions that address specific challenges within a GCC’s operational framework. Whether through cutting-edge research on emerging technologies or tailored advisory on sector-specific issues, these enablers help GCCs stay ahead of the curve.

Their insights inform strategic decisions, drive product innovation, and help refine operational processes—becoming trusted partners for GCCs exploring new business models and efficiencies.

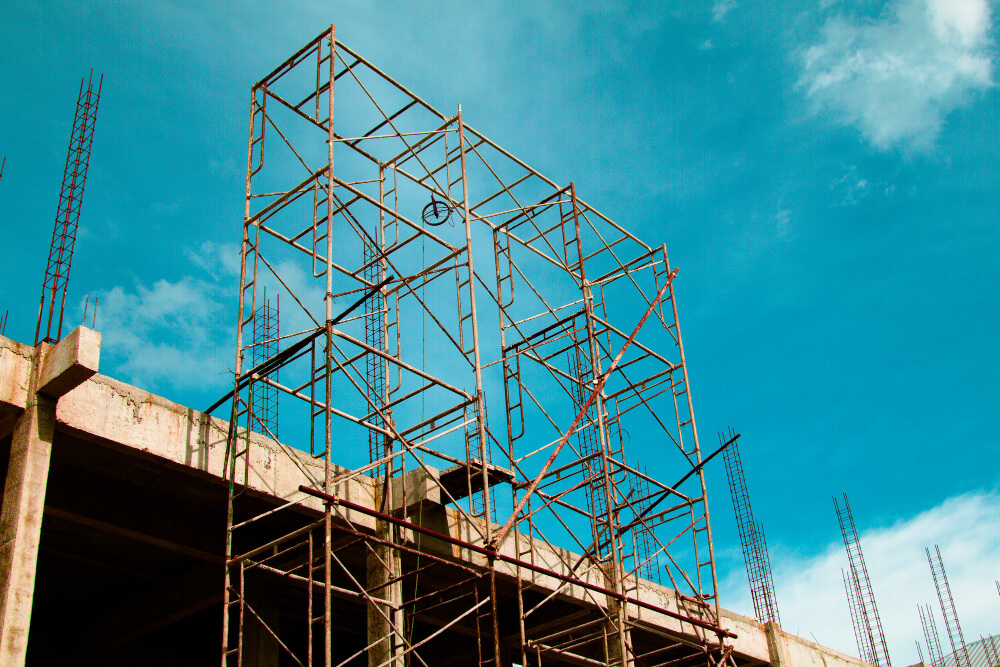

Real Estate Players: Establishing the Physical Infrastructure

While much of the conversation around GCCs focuses on digital transformation, the physical environment remains a critical factor. Real estate developers and builders are essential enablers, providing the state-of-the-art infrastructure that supports the dynamic activities of GCCs. Modern GCC hubs are more than just office spaces—they are ecosystems designed to foster collaboration, creativity, and productivity.

Real estate players work in tandem with corporate leaders and consulting firms to develop campuses that are not only technologically advanced but also conducive to an innovative work culture. With sustainable designs, modern amenities, and flexible layouts, these developments attract top talent and facilitate seamless cross-functional collaboration.

The Role of Academia: Nurturing Innovation and Future Talent

Academic institutions play an indispensable role in this enabler ecosystem by acting as a bridge between theoretical research and practical application. Universities and research centers collaborate with GCCs to pioneer new technologies and develop innovative business models.

Through sponsored research, joint labs, and internship programs, academia not only supplies a steady pipeline of skilled graduates but also contributes breakthrough insights that can be directly applied to operational challenges. These partnerships foster an environment where emerging ideas are nurtured and rapidly transformed into actionable strategies, ensuring that GCCs remain at the forefront of technological and operational innovation.

The Synergy of a Multifaceted Ecosystem

The enabler ecosystem—comprising consulting firms, talent acquisition agencies, research and boutique firms, real estate developers, and academic institutions—forms the backbone of successful GCCs. Each element plays a unique role, but their combined efforts create a synergistic effect that drives global operational excellence. Consulting firms provide strategic vision, talent acquisition agencies ensure a steady stream of skilled professionals, research and boutique firms offer innovative solutions, real estate players lay down the physical groundwork, and academia fuels ongoing research and talent development. Together, they create a robust support system that enables GCCs to tackle complex challenges, adapt to market shifts, and continually evolve.

A Collective Force for Transformation

In conclusion, the enabler ecosystem is not merely an adjunct to the success of Global Capability Centers—it is the engine that drives their transformation. As GCCs continue to evolve into centers of innovation and strategic value, the collaborative efforts of these enablers will be increasingly critical. For companies looking to build or expand their GCC operations, investing in these partnerships is not just a strategic advantage—it is a necessity.

At GCC Pulse, we believe that understanding and leveraging the enabler ecosystem is key to unlocking the full potential of Global Capability Centers. By fostering collaboration across consulting, talent acquisition, research, real estate, and academia, organizations can ensure their GCCs are not only prepared for the challenges of today but are also poised to lead in the future.